How do i withdraw money from cryptocomCryptocurrency appWhere to buy cryptoCryptocom app not workingHow to buy safemoon on cryptocomBitcoin price coinmarketcapCours cryptoHow to withdraw money from cryptocomCrypto com wikipediaBitcoin price historyWill crypto bounce backWhen could you first buy bitcoin1 etherium to usdPolygon cryptoBtc miner appWhat is btc walletBtc miningHow much is pi crypto worthCan i buy dogecoin on cash appCryptocom loginEthereum cryptoCryptocurrency exchangesCrypto market liveCrypto earnWhat is cryptoBitgert crypto priceSpace grime cryptocurrencyOld bitcoin wallet sitesDent cryptoCrypto com exchange usaCrypto gift cards11 etherium to usd1bitcoin to dollarEternal cryptoCryptocom address whitelistingCheapest bitcoin priceBitcoin exchanges usaHow much to buy dogecoinSquare cryptocurrency priceCrypto com mainnetCryptocurrency pricesDogecoin 20 where to buyHow much is bitcoinCrypto com paymentCryptocurrency bitcoin priceElon coin on cryptocomGoogle bitcoinBitcoin appsBitcoin price cadDoge cryptoBitcoin starting priceBitcoin cryptocurrencyBest crypto news websitesHow many btc are there1 btc in usdCrypto exchangeBitcoins lowest priceEthusd converterBest crypto buying platformBitcoin trend

Bitcoin trend

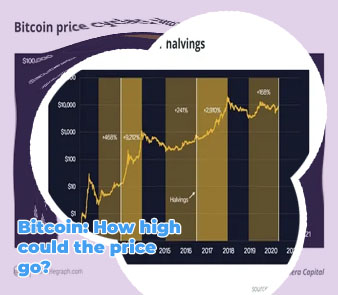

Is a bitcoin crash coming, or will the price go up more?

Bitcoin is heading into one of the most important years in its history as two major events are expected to skyrocket the digital asset. Ahead of the same, crypto market intelligence data provider Messari has provided its take on what 2024 can bring for Bitcoin and by the looks of it, Inscriptions might lead the year. Bitcoin surges it in one week Markus Thielen, a prominent research and strategy analyst, had an observation that highlights the resemblance between the current macroeconomic landscape and the situation in 2019. Then, the Federal Reserve's decision to halt rate hikes was followed by a surge in Bitcoin prices.

Bitcoin price hike

Although it looked like bad news for the sector, Bitcoin stayed steady, holding above US$25,000. This was supported by BlackRock (NYSE:BLK) filing for a Bitcoin exchange-traded fund with the SEC on June 15. Although the SEC hasn't approved applications for spot Bitcoin ETFs previously, the support from BlackRock, which is the world's largest asset manager, has proved bullish. Bitcoin returns by year Andrew Kang, MicroStrategy’s chief financial officer, added: “Our commitment to acquire and hold bitcoin remains strong, especially with the promising backdrop of increased institutional adoption.”

The Top 10 Countries that Use Crypto and Bitcoin the Most

Specifically, we find that while the prices are high (above trend), the increasing interest pushes the prices further atop. From the opposite side, if the prices are below their trend, the growing interest pushes the prices even deeper. This forms an environment suitable for a quite frequent emergence of a bubble behavior which indeed has been observed for the BitCoin currency. We believe that the paper will serve as a starting point of the research line dealing with statistical properties, dynamics and bubble-burst behavior of the digital currencies as these provide a unique environment for studying a purely speculative financial market. What if Bitcoin Collapsed to Zero? Ark Next Generation Internet ETF has sold more than 700,000 shares of Bitcoin Trust since Oct. 23, according to the ETF provider’s daily trading data compiled by Bloomberg. It offloaded 36,168 shares on Wednesday. Bitcoin Trust enables investors to gain exposure to Bitcoin in the form of security.

Will bitcoin drop

For bullish investors, these dynamics present an attractive landscape. Thorn elucidates, “This is a great setup for bulls because if spot moves moderately higher, short gamma covering could make it rip much higher pretty quickly, but if it moves lower, long gamma covering could provide some support and limit near-term downside.” How Will WEB3 Become the Next Big Thing? Bitcoin, a decentralized currency that defies the sway of central banks or administrators, transacts electronically, circumventing intermediaries via a peer-to-peer network.

|

|